We have embarked on enabling the development of a world-class technology ecosystem in Pakistan for global and local technology stakeholders.

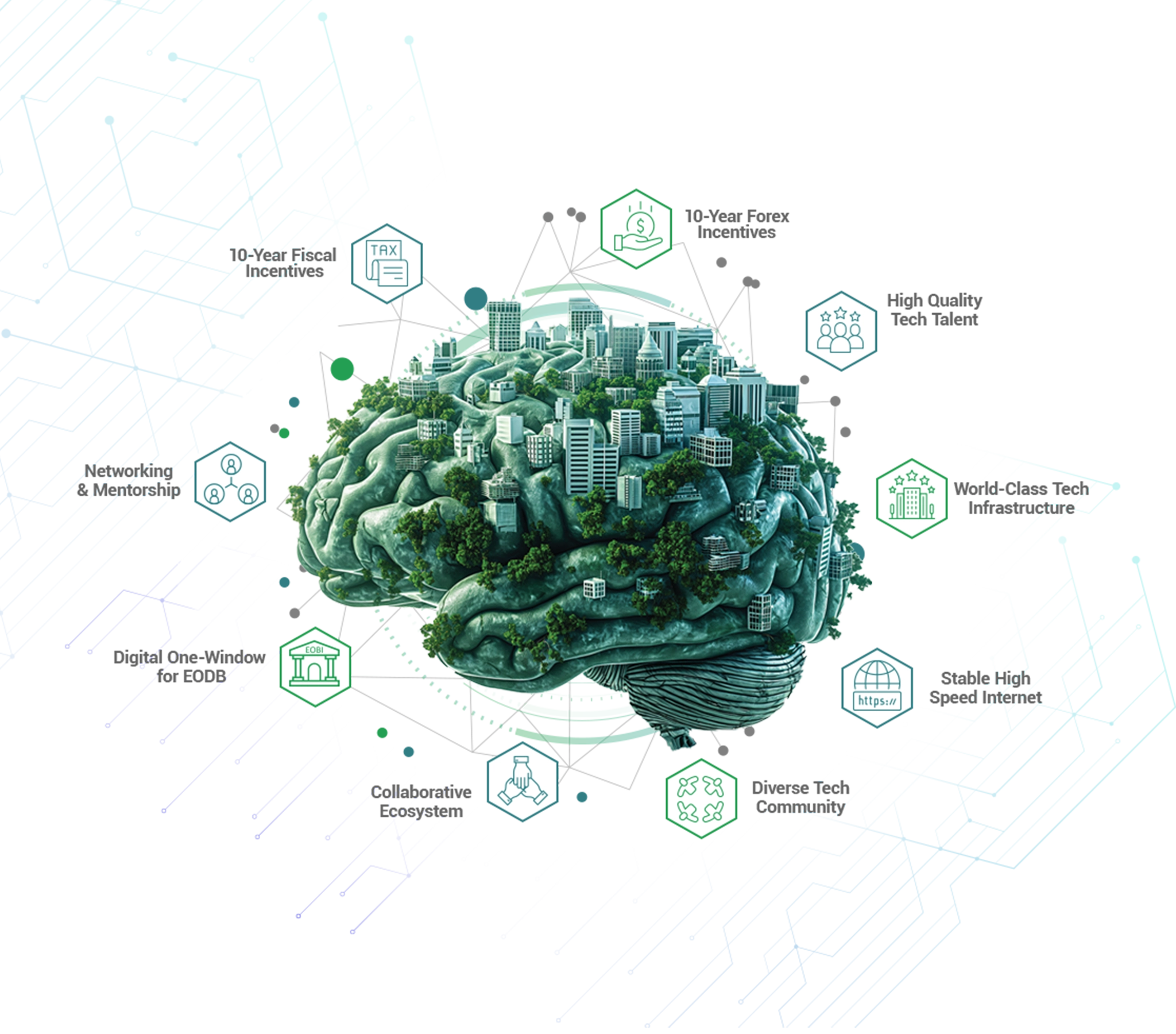

STZA offers a seamless business environment for investors, reliable technology infrastructure, 10 years of fiscal and forex incentives, and a thriving tech ecosystem to unlock Pakistan’s demographic and knowledge advantages.

The Special Technology Zones Authority (STZA) is an autonomous government body that licenses public and private investments to enable the establishment of Special Technology Zones (STZs) in Pakistan. These STZs offer businesses special incentives spanning over 10 years to promote technology exports, entrepreneurship, job creation, skill upgradation, research & development, and innovation in the tech sector.

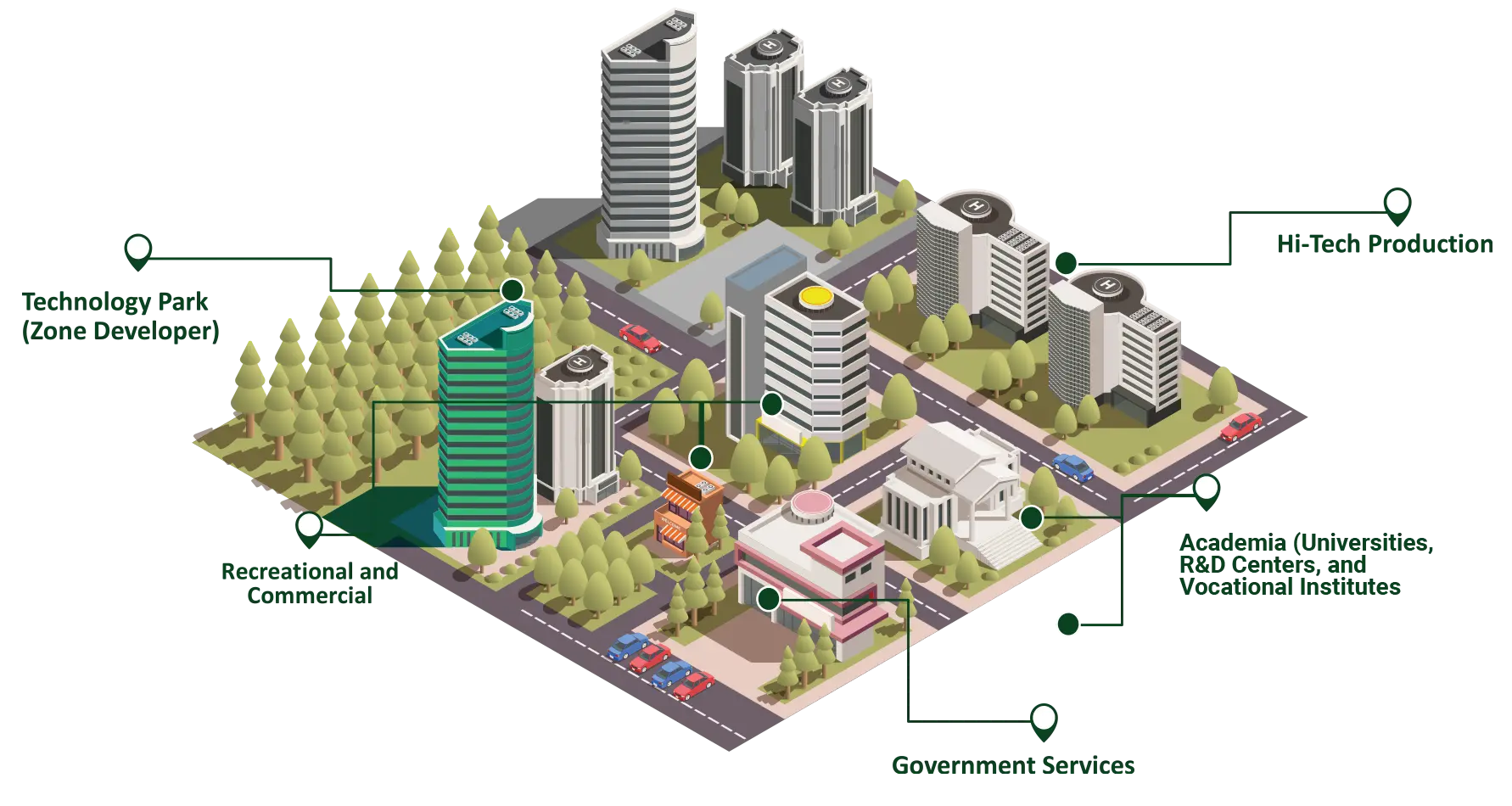

Special Technology Zones (STZs) are ring-fenced areas, approved and notified by STZA. These areas may be new parcels of land notified for the development of STZs, existing infrastructure that can be declared as an STZ, or expansion of existing STZs

Exemption from Profit and Gains Tax

Under the Income Tax Ordinance, 2001

Exemption from Minimum Tax

Under the Income Tax Ordinance, 2001

Exemption of income tax on dividends & long-term capital gains of Venture Capital Funds from their investments in Zone Enterprises

Under the Income Tax Ordinance, 2001

Under the Customs Act, 1969

** Exemptions are valid for a period of 10 years from the date of issuance of License

Under an active license, Zone Entities are eligible

for opening and maintaining a Special Forex Currency Account

Special FX Accounts can be fed with any proceeds from abroad without the requirement of conversion to PKR

All legitimate payments abroad allowed from the funds available in the Special FX Accounts, without any limitation or approval from SBP

Local payments from the special Forex accounts allowed in PKR

** permission for opening and maintaining foreign currency accounts is valid for a term of 10 years after the issuance of license

by attracting tech companies and fostering entrepreneurship within the zone

by bringing together researchers, businesses, and academia, leading to innovation and knowledge sharing

through partnering with training centers and attracting talent, creating a strong workforce for the tech sector

like high-speed internet, research labs, and advanced facilities to support tech businesses’ needs

Sign up to STZA’s Digital One Window Portal and follow the step-by-step guide to complete the application process.

All applications are thoroughly assessed.

Licenses are granted only after a unanimous decision by the relevant STZA committees.

New State Life Tower, Plot#61, 16th Floor, F-7/4, Islamabad.

Consequent to the Government of Pakistan’s commitments under the Extended Fund Facility, no new applications for Zone notification shall be entertained until further orders.